What is SoFi, Ever heard about this? SoFi (Social Finance) is an American financial technology company that provides a range of financial products and services, including student loan refinancing, personal loans, mortgages, investment accounts, and various types of insurance.

Founded in 2011, it aims to disrupt traditional banking and financial services by providing more affordable and accessible financial products and services to its customers. Its target market is typically millennials and Gen Z customers who are looking for a modern and convenient banking experience.

In addition to its core financial products and services, SoFi also offers a number of other benefits to its customers, such as career coaching, networking opportunities, and educational resources on topics like personal finance and investing. The company has become increasingly popular in recent years, and as of 2021, it had more than 2 million customers.

What is SoFi Technologies?

SoFi Technologies is a publicly-traded special purpose acquisition company (SPAC) that merged with SoFi, the financial technology company, to become the parent company of SoFi. It is listed on the Nasdaq stock exchange and is primarily focused on expanding SoFi’s offerings and capabilities in the financial technology space.

They both are related but different entities. SoFi is a financial technology company that provides a range of financial products and services. At the same time, SoFi Technologies is the publicly-traded parent company of SoFi that focuses on expanding its reach and capabilities.

What does SoFi do?

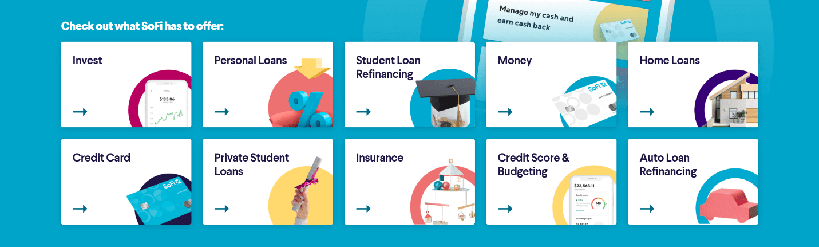

SoFi provides a range of financial products and services, including:

1. Student loan refinancing: SoFi offers student loan refinancing options that can help borrowers save money on interest and potentially pay off their loans faster.

2. Personal loans: It provides personal loans for a variety of purposes, including debt consolidation, home improvement, and major purchases like weddings or medical expenses.

3. Mortgages: SoFi offers mortgages with competitive rates and flexible terms, including options for first-time homebuyers, jumbo loans, and refinancing.

4. Investment accounts: It provides investment accounts for individuals who want to invest in stocks, ETFs, and cryptocurrency.

5. Insurance: It offers a range of insurance products, including life insurance, renters insurance, and home insurance.

6. Cash management: SoFi’s cash management products include a high-yield cash account and a debit card with no account fees or minimums.

In addition to these core financial products and services, SoFi also offers various perks and benefits to its customers, such as career coaching, financial planning tools, and member-exclusive events. Overall, it aims to provide a modern and convenient banking experience that is tailored to the needs of its customers.

CBNA24 Online Desk Report (FHBD)

Click to visit our Facebook Page

Click to visit our YouTube Channel

Farid Hossain

Farid Hossain